Strengthening the Lending Capacity of the Multilateral Development Bank

An important question

COVID-19 has shown, particularly in the emerging markets and developing world, a whole range of vulnerabilities in the economies of these countries. Public health systems have come under enormous strains, reflecting many decades of neglect. Budgets have been stretched, with very few countries having the fiscal space needed to respond to the crisis in a vigorous way, without imperiling the long-term health of public finances and/or without turning for immediate help from the international financial institutions.

We have known for a long time that fiscal policies in the great majority of countries in the world have exhibited a “deficit bias,” that is, a tendency, regardless of the business cycle or whether the economy in question is in a phase of expansion or downturn, to register a budget deficit. Looking at the data for 191 countries over the 41-year period 1980–2020, countries have run deficits 75 percent of the years (with many advanced economies registering deficits in every single year over this period) and this tendency has intensified over the past decade, following the 2008 global financial crisis. This deficit bias has led to the rapid build-up of public debt, a process that has picked up speed in 2020 as a result of the fiscal interventions necessitated by the pandemic.

Against this background, the role of the international financial institutions and multilateral development banks has acquired renewed relevance. In the aftermath of the pandemic some 80 countries have received support from the IMF’s Rapid Credit Facility and Rapid Financing Instrument (RFI), the latter a facility providing fast-disbursing support to countries experiencing commodity price shocks, natural disasters, and other fragility-related emergencies. Thus far, as of this writing, the IMF has approved some US$87.4 billion under the RCF and RFI and other facilities, against financing needs (conservatively estimated) in these countries likely in excess of US$2.5 trillion. (However, of the US$87.4 billion, a full US$45.7 billion correspond to three Flexible Credit Lines for Chile, Colombia and Peru; actual IMF disbursements thus far, therefore, account for no more than 1.7 percent of the IMF’s own estimates for the financing needs of emerging markets and developing countries). Other official lenders such as the World Bank and the regional development banks such as the IDB have also stepped in with emergency funding.

Given the volume of interventions announced thus far in the more advanced economies and given the present and prospective needs for financial support in coming years in the developing world, one can legitimately raise the question of whether the collective “firepower” of the international financial institutions and the multilateral development banks—meaning, the aggregate amount of financial resources available for assistance to their members—is adequate to the task at hand. And the task is not simply meeting the needs arising out of the dislocations provoked by COVID-19, enormous as they are, but also those that will emerge in coming years from multiple climate change-related disruptions, as well as the whole range of other development needs which remain, such as persistently high levels of poverty, widening income disparities, the need to rebuild dilapidated physical infrastructure, to improve the quality of educational systems as we rise to meet the challenges of technological change for the future of work and the job markets, among others. Our answer to this question is a resounding “no”.

This note will address the issue of boosting the lending capacity of multilateral lenders. The first part of what follows is focused on the development banks. A separate (shorter) section deals with the adequacy of IMF resources. The proposals presented here are offered in a spirit of constructive dialogue, mindful of something that Winston Churchill said in 1940 in the middle of World War II: “in this crisis we must not let ourselves be accused of lack of imagination.”

Mobilizing the private sector for development: A sponsored loans program

The intent of this proposal is to look beyond the conventional funding mechanisms of the multilateral development banks, which have historically consisted of periodic capital increases funded by member countries. This mechanism may continue to be used in the period ahead, but it has its own limitations. First, the amounts collected in recent rounds have not been especially large. To take an example: the IDB’s ninth general capital increase (GCI-9) went into effect in February of 2012 and consisted of $1.7 billion of paid-in capital, to be paid by members over a period of five years, as well as $68.3 billion of so-called “callable” capital. According to a Standard & Poor’s report on the IDB, payments of the annual instalments have often been late and “as we expect the IADB to continue distributing $200 million yearly in grants to Haiti until 2020, the gains from GCI-9 are largely offset.”1 Second, budgets everywhere are under pressure and there is every reason to expect that member countries will see such capital contributions competing with other urgent claims on scarce budgetary resources, against the background of rapidly rising public debt levels. Indeed, in some official circles, this funding model is seen as having been virtually exhausted.

This proposal starts by suggesting at the outset that the multilateral development banks should explore innovative mechanisms to mobilize private sector resources in support of social and economic development programs. The unusual low-interest-rate environment which has been a chief feature of the post-global financial crisis world has created a situation today where upwards of US$15 trillion of private sector wealth (equivalent to over 17 percent of world GDP) is earning negative yields. A broad range of institutional investors and some 2,800 billionaires keep, on average, some 22 percent of their asset holdings in cash. Many of the holders of private sector wealth might want to deploy some of their assets to finance promising development projects aimed at addressing some of the most urgent needs of our time, from the mitigation of climate change, to the persistence of poverty, the pervasive nature of gender discrimination and other problems which, if allowed to fester, could pose substantial risks to sustainable economic growth and undermine the social and institutional foundations for continued wealth creation.

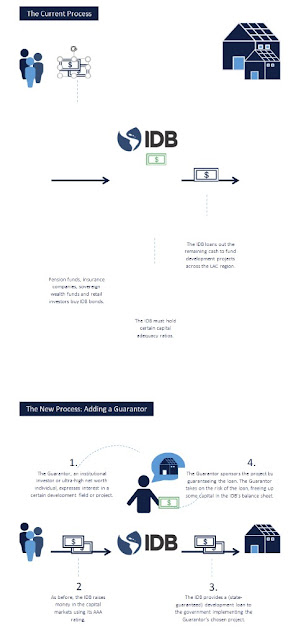

The sponsored loans program is a scheme where a private sector investor expresses an interest in a particular development project, reflecting her/his own sense of social and economic priorities. We will call this investor the Guarantor. For example, the IDB could receive from the Guarantor an amount—say US$100 million—as an equity-like instrument, and these funds would be used exclusively to guarantee IDB loans for the duration of the time horizon. The IDB would raise money in the capital markets using its AAA rating and on-lend the resources to its members to finance the project in question under the traditional state guarantee. Because the Guarantor takes on the risk of the loan the IDB would have a lower capital charge allowing it to further expand its balance sheet. The investor maintains his cash position in the long run (assured of a non-negative yield) while supporting development goals in the short to medium-term.

By sponsoring the loans, the Guarantor would make available resources to tackle a range of development challenges around the world or, as in the case of the IDB, in the LAC region. The Guarantor’s money would be used only in the event of a government default, a highly unlikely occurrence given the bank’s distinguished loan repayment historical track record. Multinational corporations could become guarantors as part of their corporate social responsibility strategy. Loan sponsorships could be split between several Guarantors who might share a common interest in a particular project—viz. the promotion of gender equality. Annex I lays out a simple graphic representation of the sponsored loans program proposal.2

In the paragraphs that follow, we present three examples of the sorts of projects that might be funded under this program. The sponsored loans program could substantially enhance the lending capacity of the multilateral development banks. Indeed, in theory, the binding constraint would no longer be internal debt-to-equity ratios in lending operations or the fiscal situation of its official shareholders, but rather identifying worthy projects that might excite the imagination of private investors, who would be taking on all of the risk. This, in turn, might lead the financial institutions to modernize internal procedures and structures, so as to be able to take on a potentially much larger volume of projects, but also to examine whether they are appropriately staffed with respect to experience, talent and skills.

Project I: Tackling persistent gender inequalities

A powerful database compiled over the past decade at the World Bank and now covering 190 countries has established that there are multiple discriminations against women embedded in the laws of countries, from the Constitution, to the Civil Code, Company Law, the Tax and Labor Codes, Family Law and a handful of other legal instruments. Governments have been using the law to undermine women’s property rights, to limit their mobility, to place constraints on their ability to join the labor force, to deprive them of adequate protections against domestic violence, and, in sum, to turn them into second-class citizens. The latest update of the database shows a total of 1,669 such discriminations in the laws of these countries, with fewer than 5 percent of the countries having legislation that is fully gender neutral. In some countries, the data identifies well in excess of 20 such overt discriminations against women. Not surprisingly, the consequences of these legal restrictions are devastating from an economic development perspective. They are associated with lower labor participation rates for women, lower school enrollment rates of girls relative to boys, a larger wage gap for women relative to men, and lower numbers of women-owned businesses, since the discriminations discourage female entrepreneurship.

Because of the constraints imposed by the restrictions on women’s economic agency, lower labor force participation rates for women will, in turn, mean less empowerment of women within the family, as her ability to contribute to family income is impaired, resulting in lower spending on education, health, and worse investment and savings behaviors. While the countries with the largest numbers of discriminatory indicators are located in Sub-Saharan Africa, the Middle East and North Africa, these are present nearly everywhere, including in high-income countries.3 The World Bank has been extremely reluctant to use loan conditionalities to persuade countries to amend their legislation to eliminate such discrimination, despite this being a win-win outcome for all stakeholders.4 What progress has taken place over the past decade in dismantling such restrictions has been through the initiative of some (enlightened) governments, and pressure from civil society and the media, made possible in part by the highly public nature of the data. But the progress has not been as far-reaching as might be desired and the discriminations/restrictions continue to discourage women and create a toxic environment that sharply limits their opportunities.

Project II: Developing alternative metrics of human welfare

Since the 1950s when the UN system of national accounts came into existence, we have used GNP/GDP figures as the primary metric of economic success. From the point of view of political leaders, their economic advisors and the peoples whose material interests they have been elected to protect, no economic policy which failed to deliver continued GDP growth would ever be considered a “success.”

The adequacy of this approach, however, has increasingly come into question, partly stemming from concerns about the burden on the environment associated with growth beyond the present scale and, more fundamentally, from new insights from behavioural economics about the relationship between growth in the economy and the well-being of communities. This is not the place to go into a detailed analysis of the flaws of GDP. There is an extensive literature accumulated over the past three decades highlighting its limitations as a sensible measure of human well-being; some of the more insightful commentary has focused on the perverse incentives provided by an accounting system that, to take an example, treats the depletion of natural resources as current income and thus as a positive contribution to the growth of GDP.5 Indeed, the emergence of the Human Development Index (HDI) in 1990 was an early attempt to capture broader aspects of socio-economic development.

An even more sophisticated example is the Index of Sustainable Economic Welfare (ISEW) developed by Herman Daly and John Cobb in the 1990s, which later evolved into the GPI (Genuine Progress Indicator). The GPI included a valuation of household work and incorporated the negative effects of such factors as long-term environmental damage, depletion of non-renewable resources, costs of pollution and other welfare-destroying phenomena. Daley and Cobb demonstrated that in the United States inflation-adjusted income per capita using the ISEW was some 4 percent lower in 1990 than in 1966; over the same period traditionally measured GDP per capita rose by 55 percent.

The challenge we face in this area is not mainly about the need to come up with a metric that will better capture aspects of human welfare and well-being, desirable as that may be. It is rather that by not doing so, by continuing to rely on a flawed metric, we are formulating and implementing economics policies on a planetary scale that are delivering stunted, unbalanced development. The result has been growing levels of income inequality, and a disregard for the quality of our global environment and the ecosystems that are essential to safeguard the sustainability of the very growth which we recognize is necessary to continue to reduce poverty, enhance opportunity and improve human welfare.

As with the previous example on gender inequality, it is not difficult to imagine how an investor (the Guarantor in our description) might wish to finance a project aimed at creating complementary indicators to GDP that might provide a basis for the implementation of sounder policies, thus providing a better alignment of intergenerational incentives and more explicitly encouraging notions of sustainability in long-range policy design.

Project III: Supporting the environmental transition in agriculture

The shift to intensive industrialized agriculture with a narrow genetic base and extensive chemical inputs has been highly profitable for multinational corporations, but has intensified soil loss, degraded water supplies, driven rural-to-urban migration, accelerated land conversion from forests and threatened biodiversity, among other social and environmental impacts. Agriculture is a major contributor to climate change, with deforestation and loss of soil organic matter turning carbon sinks into sources, while high emissions of methane from cattle and sheep—amounting to two thirds of human-induced emissions of this powerful greenhouse gas—are rising rapidly. This unsustainable system is also threatening long-term food security. At the same time, the rural poor have increasing difficulty in surviving, and their young are drawn to better opportunities in the crowded cities.

World agriculture needs a socially- and environmentally inspired revolution that can address a number of problems simultaneously. It would combine many innovations adapted to each local situation, whether in wealthy countries or for the rural poor of Africa, Asia, Latin America, and the Caribbean. This new agriculture reinforces local food security, creates employment, furnishes a reasonable living to smallholder families, and provides incentives to live successfully in rural areas. It would include innovations providing rural access to renewable energy and communications technologies to overcome the digital divide and raise the rural standard of living. A variety of techniques for soil restoration from no-till farming to basalt dust application and agroforestry would restore the planet's productive capacity, while capturing and storing carbon to reduce global heating.

Phasing out the excessive number of ruminants (cows and sheep) or including algae in their diet would counter their role as major methane emitters. This would also address the inefficiency of meat as a human food source in a food-short world, while ending the destruction of rainforest to grow soybeans as animal feed and provide pasture for cattle. While considerable attention has been paid to producing electric cars, much still needs to be done to replace fossil-fuel-powered agricultural machinery, such as tractors and harvesters with equivalents powered by renewable energy. Where climate change is affecting traditional crops and agricultural practices, alternatives need to be developed. Since rural populations are least able to raise the capital for such changes, and to make the transition from unsustainable practices to new systems, this is an obvious area for external financial support for everything from research to infrastructure to local extension and implementation, yielding multiple economic, social and environmental benefits.

A related need is the reforestation of abandoned land with mixed native trees, both to capture carbon and restore biodiversity. The need for environmental restoration is widespread, ranging from areas heavily impacted by soil erosion, such as the Loess Plateau region of China and the great plains of North America, to urban parks and gardens to bring nature back into cities. These efforts can produce visible results at a time scale that would be rewarding to Guarantors enabling their funding.

Boosting the IMF’s firepower

As noted earlier, the IMF is playing an important role in providing financial support to countries currently trying to manage the fiscal pressures arising out of COVID-19. In this pandemic emergency, as well as other periods in the past characterized by widespread global disruptions to economic activity, the amount of support the Fund can provide has traditionally been limited by the size of the country’s membership quota; and there is obviously an upper limit on total available resources. As of end-March 2020 the IMF’s “lending capacity” was equivalent to SDR 715 billion (or around US$ 976 billion) consisting primarily of IMF quotas (SDR 320 billion) and multilateral and bilateral arrangements which the IMF has negotiated with member countries and institutions, to provide so-called second and third lines of defence, and supplement quota resources. While this sum may seem large, in July of 2020 it is equivalent to slightly less than 3 percent of cross-border claims of Bank of International Settlements (BIS) reporting banks, 0.4 percent of total global debt and 1.1 percent of world GDP. It is, hence, a relatively modest sum, adequate to deal with a handful of crises in a few middle-income countries, but insufficient in a major crisis such as that brought about by COVID-19.6

In recent months a number of analysts and public officials have made a case for a Special Drawing Rights (SDR) issue, the IMF’s only form of universal unconditional liquidity. The SDR came into being in 1969 as an attempt to bolster countries’ official reserves. The second amendment to the IMF’s Articles of Agreement actually envisages that Fund members will make the SDR “the principal reserve asset in the international monetary system.”7 And Article XVIII, on the principles governing the allocation of SDRs, states that “the Fund shall seek to meet the long-term global need, as and when it arises, to supplement existing reserve assets in such manner as will promote the attainment of its purposes and will avoid economic stagnation…”. There have been three SDR issues over the past 51 years, by far the largest of which took place in 2009 (equivalent to US$250 billion), as a response to the financing needs of the global financial crisis.8

That last SDR issue was agreed to at a G20 summit in London and there is no doubt that it made an important contribution to boosting confidence and was seen as a strong signal of international cooperation in the midst of a systemic shock to the global financial system. The case for an SDR issue today on the basis of need would appear to be compelling, given that this crisis is tangibly more intense and costly in terms of human welfare than the global financial crisis a decade ago, when global GDP contracted by 0.1 percent in 2009, before recovering quickly in 2010 and thereafter. Or, to put it in another way: if this is not the time to make an SDR issue, in the middle of unprecedented dislocations to global economic activity, then one might ask under what set of circumstances could such a move be justified?9

There is no attempt here to minimize some of the technical complexities that emerge in efforts to make the SDR “the principal reserve asset in the international monetary system.” That is not the issue under discussion. One can also be sympathetic to the concerns raised in some high-income countries that because countries’ SDR allocations would be linked to the size of their IMF quotas, much of the benefit would be concentrated in the larger countries. But this was not a concern in 2009, given the fairly generalized nature of the shock, which put countries’ finances—including in the advanced economies—under huge stress.10 Likewise, there is little likelihood that, in the middle of an economic calamity without precedent, an SDR issue of, say, SDR 720 billion (about US$1 trillion at today’s exchange rates) would be inflationary. Indeed, most of the advanced economies have responded to COVID-19 with large packages of financial support under the overall heading of “whatever it takes” which recognized explicitly that inflation was not a primary (or even secondary) concern.

More generally, there would appear to be an urgent need to overhaul and simplify the system under which the Fund may issue SDRs under exceptional circumstances, such as times of crises.11 When this idea was first put forward in the early 1980s, concerns were raised about the possibly inflationary implications of such liquidity injections, but international inflation was a serious problem then in ways that it is clearly not today, and measures could be introduced to safeguard against this. Furthermore, the size, integration and complexity of financial markets today dwarfs what we had in the 1980s and the costs of an unresolved systemic crisis today are potentially extremely high. In any case, reforms in this area should also introduce protections to limit moral hazard. The idea is to put in place well-funded crisis financing mechanisms available to all IMF members, as an alternative to precautionary reserve accumulation, which is what countries have done in recent decades in a big way. There are enormous inefficiencies in the accumulation of war chests denominated in hard currencies as a way of providing a protective barrier during periods of market volatility. As part of its efforts to improve global liquidity management, the IMF should be allowed to mobilize additional resources by doing the following: tapping capital markets and issuing bonds dominated in SDRs (something that would not require amending the Articles), making emergency SDR allocations under considerably more stream-lined procedures, and, as noted previously, allocating SDRs regularly to supplement the demand for “own reserves.”

One possible concern which has not been addressed in official public commentaries, but which is surely an issue worth debating is that SDR allocations are made to all IMF members. This would include countries that are currently failed states, or which may be run by politicians involved in the drug trade, financing global terrorism and sponsoring generalized mayhem in various parts of the world, or countries that have otherwise not fulfilled vital obligations of membership (e.g. Venezuela has not had an Article IV consultation with the Fund since 2004). The financial boost provided by an SDR allocation could thus, in some cases, have adverse collateral effects and not in any way be of benefit to citizens. Corruption and bad governance are serious enough problems to make this a real and legitimate concern, but the solution to this lies elsewhere, not in depriving all IMF members of the financial lifeline that an SDR issue would provide at this very difficult time. This, in turn, raises questions about IMF governance and the future role of the SDR which are beyond the scope of this note; suffice it to say that we all have a vested interest—governments, the private sector, citizens everywhere who often pay a high price during periods of global economic dislocation—in having an IMF that is able to respond quickly, effectively and generously in times of crisis.

Annex 1: Sponsored Loans